ZATCA refers to Zakat, Tax and Customs Authority and is the first phase of e-invoicing in the Kingdom of Saudi Arabia where all businesses are required to begin its usage from December 4th 2021. ZATCA or e- invoicing helps processing of invoices, credit notes and debit notes in a structured electronic format.

E-invoice Implementation in KSA

E-invoice implementation helps business to function more securely and efficiently. Here the company data is combined with ZATCA to make the trading system more transparent. This phase mandates integration of ERP/POS systems and billing software with the ZATCA`s Fatoorah Portal. Confirming the e-invoices via ZATCA portal also helps identify fraudulent practices. This also assists tax officials in reducing the frequency of their audits.

What is NC365 ZATCA E-INVOICING SOLUTION?

NC365 ZATCA E-Invoicing Solution is developed by NASCONCEPTION to assist companies in Saudi Arabia who are existing Microsoft D365 Business Central users to process invoices, credit notes and debit notes in an electronic format and help streamline operations, simplify reporting and ensure tax compliance in the country.

Advantages of NC365 ZATCA E-Invoicing Solution

- With streamlined invoicing, business owners are less likely to face problems.

- Generation of invoices for tax refunds will be done in real-time.

- Facilitates enhanced data protection.

- Lesser chances of fraudulent actions

- Automated invoicing and real time data synchronization result in significant time saving.

- Reduced chances of errors from manual data entry promoting accurate invoicing and financial reporting.

- Streamlined processes and reduced manual intervention enhances productivity.

- By reducing manual processes and errors, business in Saudi Arabia can achieve cost savings.

- Adopting technology- driven solutions like the NC365 ZATCA E-invoicing solution ensures businesses are well prepared for the future. The modular nature of this software ensures scalability and adaptability as businesses evolve.

Two Phases of E-invoicing

Phase One-

Also known as the generation phase, taxpayers will generate e-invoices and save them beginning from December 4 2021. You are also provided a ZATCA compliant e-invoicing system throughout this period.

Phase Two

In the integration phase, you are required to connect e-invoices with the ZATCA system for verification from January 1, 2023. You will be provided with an integration notification six months in advance.

Guidelines for ZATCA Approved Business in KSA

- The e-invoicing requirements will cover all taxable products and services subject to VAT.

- The process will be mandated for all VAT registered businesses in Saudi Arabia and third parties submitting invoices on behalf of a taxable person.

- All B2B and B2C transactions are required to invoiced electronically.

- The standard languages for e-invoicing will be Arabic and English.

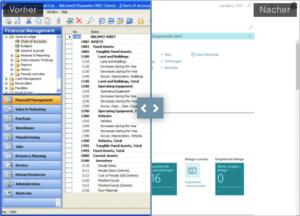

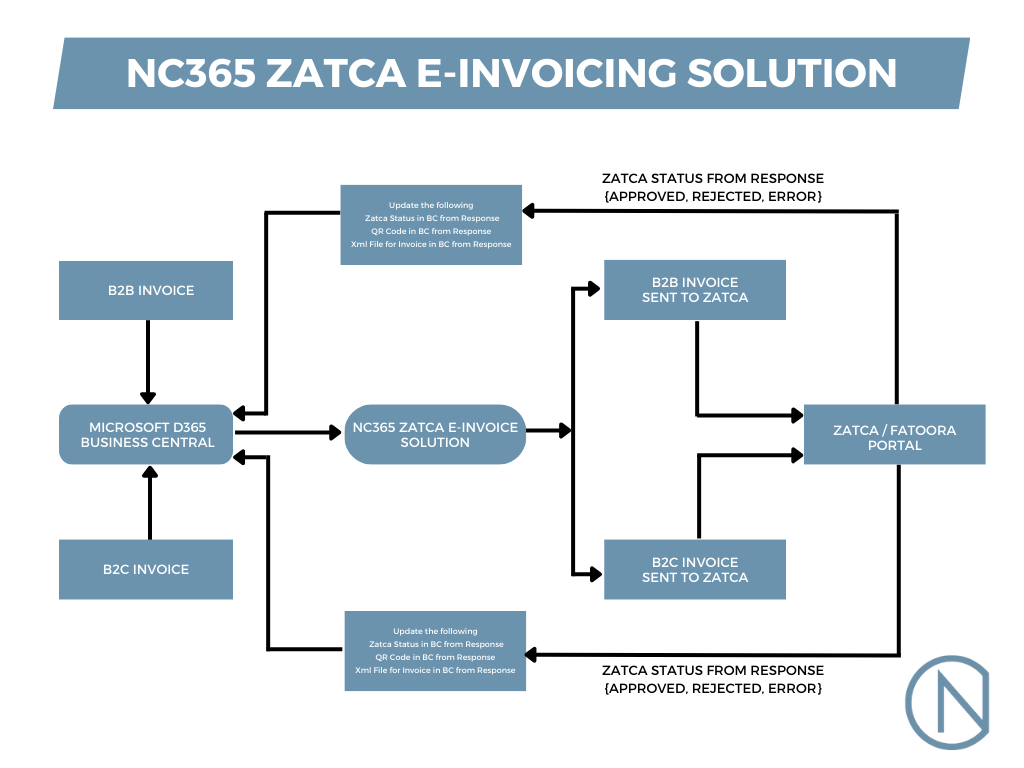

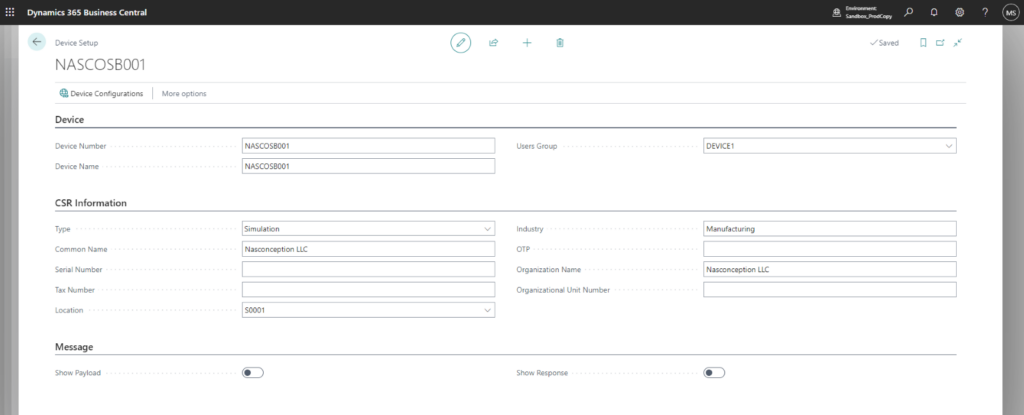

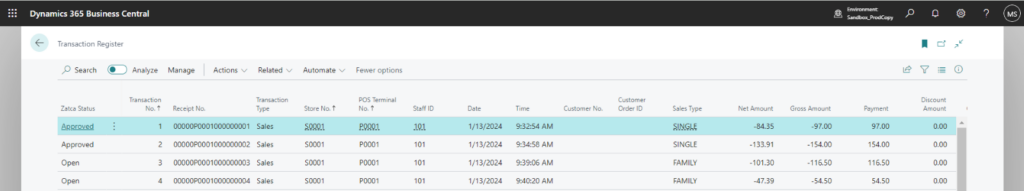

NC365 Zatca E-invoicing B2C & B2B Process

Output of Zatca E-invoicing in Business Central

By understanding the various integration modes and leveraging solutions like Nc365 ZATCA E-invoicing, businesses can ensure a smooth transition to e-invoicing in Saudi Arabia. This compliance not only meets regulatory requirements in the region but also improves efficiency and transparency in tax operations.

We are the leading and trusted Microsoft Gold Partner providing comprehensive cloud solutions and services catered to the distinct requirements of the businesses.

With over 12 years of expertise, our certified and experienced Microsoft Business Central professionals offer implementation, customization, training and support services.

Consult with Us: Contact – NASCONCEPTION FZCO

If you need to know more about ZATCA e-invoicing solution for KSA, contact us at or call us at + 971 56 839 6669.