To achieve financial excellence in today`s business landscape, enterprises must embrace contemporary solutions that revolutionize traditional practices. Here is where Bank Reconciliation comes into the picture. Bank Reconciliation serves as a cornerstone in financial management, guaranteeing record accuracy by aligning internal data with bank statements.

Microsoft Dynamics 365 Business Central, the leading ERP solution introduces Microsoft Copilot- an advanced AI tool that is all set to transform the Bank Reconciliation process.

Let`s dive into the blogpost and explore the revolutionary capabilities of Copilot, examining how it transforms the financial management landscape within Business Central.

Amidst intensifying demands for precision in financial operations, incorporating Copilot emerges as a strategic decision, positioning businesses to embrace AI-driven efficiency and accuracy in the foreseeable future.

What is Co-Pilot in Business Central?

Before we delve deeper into Bank Reconciliation features, let`s quickly have a look at what Copilot is. Dynamics 365 Copilot is the AI powered solution for your business that will change your life. Co-pilot is your new virtual assistant- ready to tackle any obstacles that come your way. It utilizes state-of-the-art machine learning and natural language processing technologies to automate mundane tasks, optimize workflows, and provide you with immediate, actionable insights.

Copilot Features in Business Central

Copilot’s AI-powered abilities can be applied across numerous business functions, including:

- Sales and Marketing: Craft captivating product descriptions, enhance targeted marketing campaigns, and customize customer engagements.

- Financial Management: Automate the entry of financial data, deliver real-time insights into cash flow, and pinpoint potential financial risks.

- Inventory Management: Enhance inventory management, forecast demand fluctuations, and automate procurement procedures.

- Supply Chain Management: Enhance visibility across the supply chain, detect potential disruptions, and streamline logistics planning.

- Project Management: Automate scheduling tasks, monitor project progress, and detect potential risks and delays.

The fusion of Copilot and Dynamics 365 Business Central marks a substantial advancement in the progression of business technology. Copilot empowers professionals to carry out their daily tasks with the support of advanced AI technology. As AI evolves further, we anticipate the emergence of even more innovative applications and benefits, making Copilot as an essential tool for organizations utilizing Microsoft Business Central.

Features of Copilot Bank Reconciliation

When tackling Bank Reconciliation, Copilot proves to be a valuable ally, automating and guiding users through the process.

Utilizing machine learning and artificial intelligence, Copilot provides proactive assistance with its key features:

- Automated Transaction Matching: Utilizing pattern recognition, Copilot automatically matches transactions between the company’s records and bank statements.

- Transaction Suggestions: The tool suggests potential matches for unmatched transactions, reducing manual effort and speeding up the reconciliation process.

- Adaptive Learning: Copilot learns from user behavior, enhancing accuracy over time by adapting to the organization’s unique transaction patterns.

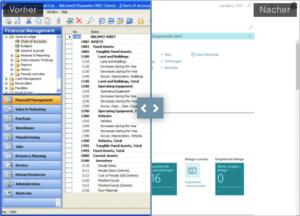

Using Copilot for Bank Reconciliation

- Activating Copilot: Ensure Copilot and AI capabilities is activated under your Bank Account Reconciliation function.

- Navigating to the Bank Reconciliation Window- To access Bank Reconciliation window, enter in the search tab “Bank Reconciliation”. The tab to Reconcile with Copilot is displayed.

- Reviewing Suggestions and Matches: Copilot automatically provides suggestions for unmatched transactions. Evaluate the suggestions and confirm matches to update the bank reconciliation status. This function is already available in Business Central, but with Copilot, the algorithm is more improved that makes bank reconciliation more efficient.

- Transfer Unmatched BankTransactions to General Ledger Account:

In the Bank Statement Lines pane, locate the unmatched bank statement lines and select the ones you wish to reconcile. These lines are the focus of Copilot for transfer to the general ledger account. Select Transfer to G/L Account to commence the process.

This action initiates Copilot’s process of generating proposals for the transfer. After Copilot completes generating proposals, the Copilot G/L Account Transfer Proposals window will appear.

This window showcases the proposals in the Matched Proposal section. The process mirrors the reconciliation experience with Copilot.

If the proposals meet your criteria and you wish to save them, select Keep It.

This action finalizes the transfer of the currently selected proposals from the bank account ledger to the general ledger account. It records new payments to the designated G/L Accounts and associates corresponding lines with the resulting bank account ledger entries.

- Managing Exceptions: Concentrate on addressing any exceptions and discrepancies that Copilot may have missed in its automatic matching process. Resolve these exceptions manually, as it contributes to Copilot’s ongoing learning process.

- Completing Reconciliation: Upon finishing the reconciliation process, finalize it and generate reconciliation reports for documentation purposes.

Bank reconciliation stands as a critical component of financial management, and within Microsoft Dynamics 365 Business Central, Copilot raises the bar for efficiency and accuracy in this realm.

Through the utilization of machine learning and automation, Copilot revolutionizes the bank reconciliation process, enabling finance professionals to operate more strategically and enhance decision-making.

In the quest for financial accuracy, integrating Copilot for bank reconciliation in Business Central emerges as a strategic step towards attaining financial alignment and optimizing routine financial tasks.

Transform your Financial Management with NASCONCEPTION

If you are looking for a comprehensive solution, we recommend our Microsoft Dynamics 365 Copilot for Business Central. This solution is designed keeping the requirements of the small and medium businesses in mind. By opting for this solution, users can avail the efficiency and accuracy of automated bank reconciliation and facilitate strategic financial decision-making.

We are the leading and trusted Microsoft Gold Partner providing comprehensive cloud solutions and services catered to the distinct requirements of the businesses.

With over 12 years of expertise, our certified and experienced Microsoft Business Central professionals offer implementation, customization, training, and support services.

By working with us, you choose fully tested and reliable software that is delivered with a complete support team based in the UAE. If you have any further questions about our software, we will be happy to help you. Consult with Us: Contact – NASCONCEPTION FZCO